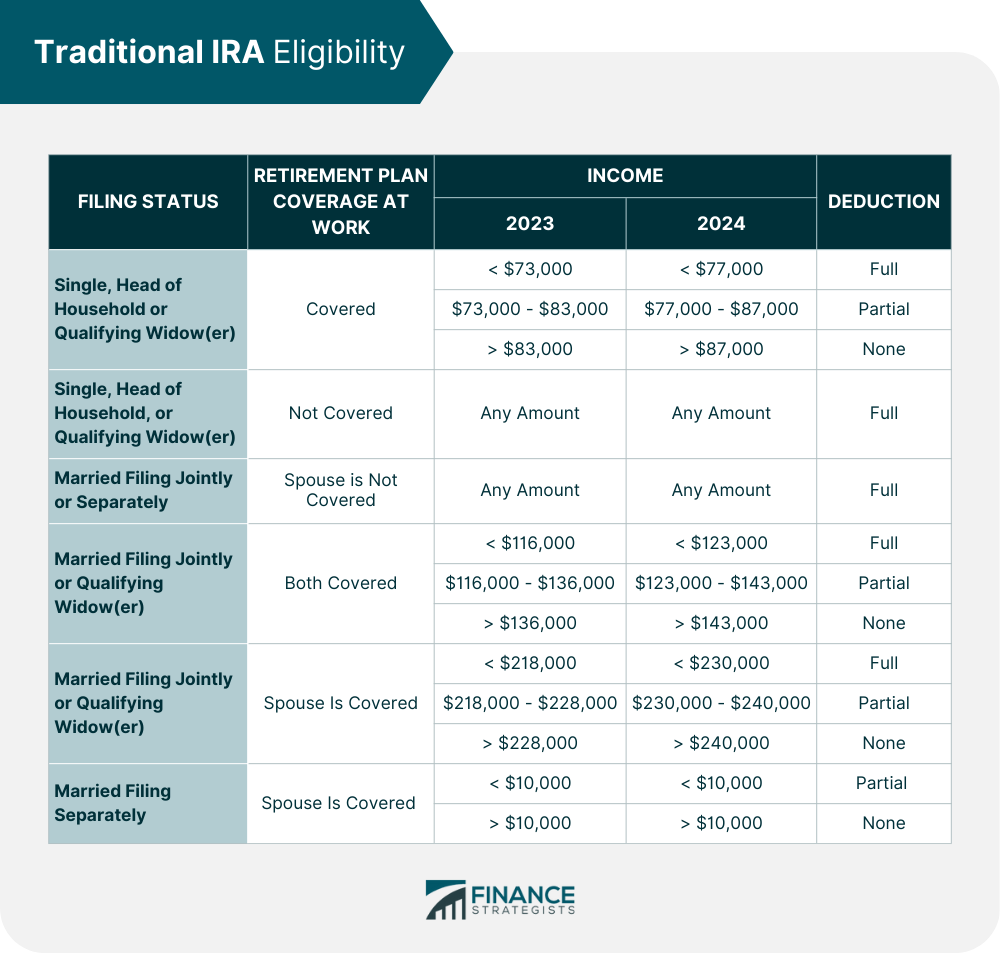

Max Traditional Ira Contribution 2025. The maximum amount he can deduct for a traditional ira contribution is $4,900, calculated as follows: Traditional ira contributions are deductible, but the amount you can deduct may be reduced or eliminated if you or your spouse are covered by a retirement plan at work.

You can contribute to an ira at any age. As noted above, the limit on annual contributions to an ira remains $7,000 in 2025—that limit applies to the total amount contributed to your traditional and roth iras.

Traditional Ira Limit 2025 Lotte Joycelin, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025 and 2025.

Roth Ira 2025 Max Bili Mariya, Plus, find out whether you'll be able to deduct these from your taxes this year.

simple ira contribution limits 2025 Choosing Your Gold IRA, 2025 contribution limits ira (under age 50):

Traditional Ira Contribution Limit 2025 Jolyn Madonna, In 2025, you can contribute up to $7,000 to a traditional ira, a roth ira, or a combination of the two.

2025 Max Roth Ira Contribution Limits Elna Zonnya, 2025 contribution limits ira (under age 50):

What Is The Gross Limit For Tax Year 2025 Bessy Lorena, You can contribute a maximum of $7,000.

Simple Ira Catch Up Contribution Limits 2025 Dael Mickie, 2025 traditional and roth ira contribution limits.